Vision of Gaming University × Pitchworks 9 Months of VC Studio Engagement

- Gokul Rangarajan

- Dec 16, 2025

- 13 min read

Building Structure Before Scale The Engagement in Memory of Rahul Sehgal.

Disclosure: Pitchworks Engaged with Gamer2Maker form Aug 2023 and this engagement did not deliver short-term revenue outcomes, aggressive growth, or closed funding.

Gamer2Maker has built Super traction organically as a gaming education platform, with 250+ students trained, 12+ years of combined instructor experience, and outcome-oriented programs that highlight an average salary benchmark of ₹7.5 lakh for learners entering industry roles. The platform is also an approved skilling partner of Medhavi Skills University (MSU), collaborating on Bachelor of Vocation and Professional Diploma programmes an important signal of institutional alignment and curriculum credibility. This blog is abotu working with Rahul and team

When Gamer2Maker engaged with Pitchworks VC Studio between August 2023 and April 2024, it was already past the idea-validation stage. There was visible demand, an engaged gaming community, and early commercial traction through courses, programs, and distribution-led initiatives. Yet beneath this momentum, the company was still operating like a creator-led venture rather than a structured organisation. Decision-making was centralised with the CEO, documentation was virtually absent, and most workflows lived in people’s heads instead of systems. The business was moving forward, but without predictability, internal visibility, or an operating model designed for scale.

What made Gamer2Maker special to Pitchworks, however, was not just the business but the Founder and the philosophy behind it. The late Mr Rahul Sehgal came to us through conversations driven by passion rather than pitch decks, speaking at length with Sudharshan about gaming, creators, and the gap between playing games and building them. Sudharshan, with over 14 years of experience in the gaming ecosystem, immediately recognised the depth of intent he always does . This was not a short-term content play it was a long-term attempt to build something meaningful in Indian gaming Education. Rahul’s vision was clear and deeply personal to build a platform almost a Universal university for gaming that could convert gamers into creators. He believed that good competition leads to better creation, and that gaming should not be limited to consumption alone. Having studied gaming in Vancouver, he had seen firsthand how structured education and ecosystems could turn passion into capability. Gamer2Maker, in that sense, was not just a company name it was a belief system.

This Blog is also dedicated, emotionally and intentionally, to Rahul Sehgal, whose recent and unfortunate passing due to health conditions deeply affected those close to him. The philosophy behind Gamer2Maker carries his imprint, and this case study acknowledges that legacy with respect. To one of the most respected game teacher in the Indian Eco system.

At the time of engagement, Gamer2Maker’s revenues were still modest, a little unorganized but largely passion-led. Much of the company was being built part-time, with Rahul simultaneously managing content, community, and visibility as a YouTube and podcast host.

The organisation reflected its stage: high passion, limited bandwidth, and a founder stretching across too many roles at once. Rahul had already built a distribution channel, around 10 K subscribers and long last engagement.

When Interacting with him and Sudarshan we often talk about two kinds of gamers: casual gamers, who play to pass time, and serious gamers, who are creators at heart. Gamer2Maker was born for the second group the ones who don’t just want to play games, but want to understand them, build them, and shape the future of gaming itself. That distinction is what made this engagement worth committing to not for immediate outcomes, but for the long-term possibility of turning passion into structured creation.

Pitchworks’ Role & Engagement Mandate

Pitchworks entered as a VC Studio style operating and advisory partner. just for limted time, as an execution agency and not as a growth marketer. The mandate was explicitly foundational to stabilise finance, bring clarity to operations, and prepare the company for scaling and fundraising readiness. The engagement was designed as a 9-month structured intervention, where Pitchworks worked alongside the founder rather than over the team. The focus was not “results within months,” but reducing structural friction that would otherwise cap long-term growth.

The Process We Followed (How We Work as a VC Studio)

Pitchworks followed a four-phase studio process that we apply across similar engagements:

Phase 1: Diagnose before prescribing Focus on understanding how the business actually runs day-to-day — finance, GTM, ops — before suggesting solutions.

Phase 2: Rebuild foundations quietly Stabilise finance, reporting, workflows, and internal visibility without disrupting ongoing execution.

Phase 3: Design GTM and scale blueprints Create structured GTM, sales, and distribution models that are ready to execute, even if not fully deployed yet.

Phase 4: Prepare for investor scrutiny

Align narrative, metrics, and operating clarity so the company can withstand investor questions and diligence.

Phase 1 – Diagnostic & Discovery

The first phase focused on understanding how the business actually functioned day-to-day, not how it was described. We ran a structured diagnostic across finance, marketing, GTM, and internal operations. This included reviewing existing financial reports, Excel trackers, and internal finance data; analysing marketing activity across Instagram, Meta ads, and Google ads; and mapping how leads moved (or failed to move) from awareness to conversion.

During this phase, we mapped workflows end-to-end for sales, launches, and distribution. One of the most significant findings was that marketing-to-conversion funnels had no consistent tracking, revenue channels were mixed with limited performance visibility, pricing logic varied across offerings, offline distribution had no defined model, investor relationships were unstructured, and there was no documentation anywhere. These were not execution failures they were structural gaps.

What Was Actually Going Well (Important to Acknowledge)

Strong demand and community engagement

High founder conviction and clarity of long-term vision

Willingness of the team to open up systems for review

Ability to execute fast once direction was clear

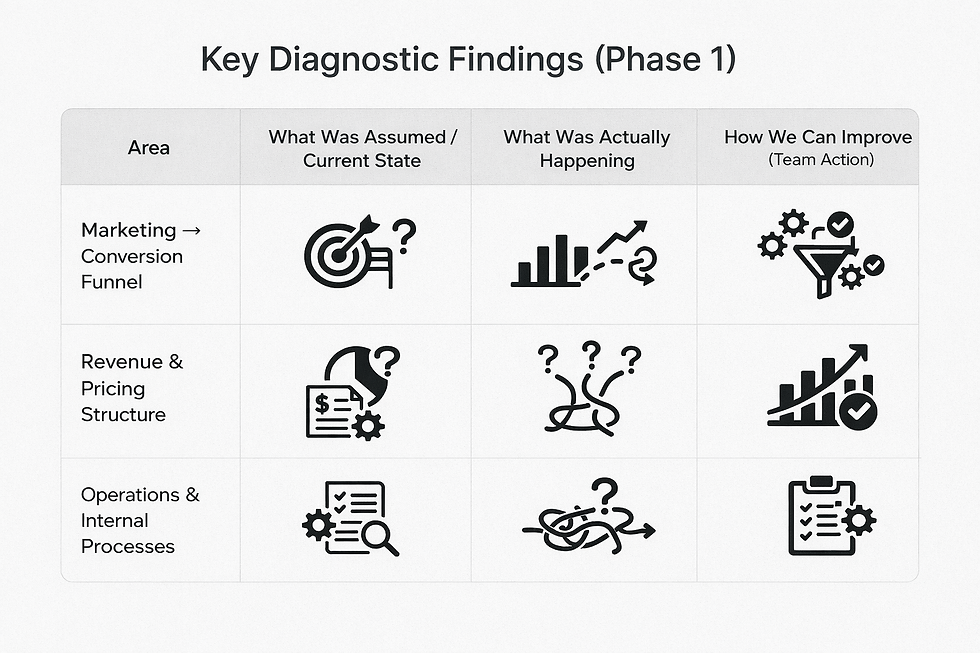

Area | What Was Assumed / Current State | What Was Actually Happening | How We Can Improve (Team Action) |

Marketing → Conversion Funnel | Leads were being generated and assumed to be converting through content and ads | No end-to-end tracking; attribution between ads, content, and sales was unclear; conversion drop-offs were invisible | Define a single funnel view, align marketing and sales handoff, track each stage consistently, and review weekly as a team |

Finance, Revenue & Pricing Structure | Multiple revenue streams were active and believed to be performing similarly | Financial model Revenue channels were mixed, pricing logic varied across offerings, and performance by channel was not clearly visible | Separate revenue streams logically, standardise pricing principles, and review performance by stream monthly |

Operations & Internal Processes | Team execution relied on experience and informal coordination | Workflows existed only in people’s heads; no documentation; offline distribution and investor interactions lacked structure | Document core workflows, assign clear ownership, and convert informal processes into repeatable playbooks |

Phase 2 – Financial Clarity & Control

The second phase focused on financial structure, handled deliberately at a high level to avoid disruption. The work here was led operationally by Mr. Radhakrishnan, with strategic oversight from Pitchworks.

We worked with:

Historical revenue and expense data (as available)

Existing internal financial summaries

Excel-based trackers used across functions

Pricing details across courses and programs

Sales-related assumptions and informal forecasts

Mixed domestic and international revenue records

Key actions included creating the company’s first structured P&L, cleaning and organising historical revenue and expense data, introducing a monthly financial reporting cadence, standardising pricing logic across offerings, and setting up a basic forecasting and sales-tracking framework. Domestic and international revenues were segregated internally on a course-wise basis to improve clarity.

Structured P&L Creation

For the first time, the business was mapped into a clear, structured Profit & Loss framework that reflected how the company actually operated.

This included:

Logical revenue categorisation by offering type

Cost grouping aligned to operational reality

Separation of fixed vs variable cost components

Clear visibility into contribution-level performance

The goal was not reporting perfection, but truthful representation.

This phase did not aim to optimise margins or drive growth. Its sole purpose was to remove financial ambiguity, so founders could make decisions with visibility instead of instinct.

Historical Data Clean-Up & Normalisation

Historical revenue and expense data was cleaned and organised to remove ambiguity and duplication.

Work done here:

Normalising inconsistent entries

Aligning time periods for comparability

Cleaning ad-hoc expense classifications

Ensuring revenue and cost were mapped to the right activity

This step was critical to avoid “false insights” later.

Area Analysed | What We Found | Why It Mattered | Structural Insight |

Primary Revenue Driver | Courses were the dominant contributor to revenue | Confirmed that the business was course-led, not event- or services-led | Courses are the financial spine of the company |

Revenue Concentration | A small set of courses contributed a disproportionate share of revenue | Helped identify focus vs distraction | Not all courses deserve equal effort |

Pricing Behaviour | Pricing varied across similar offerings without a clear logic | Created internal confusion and inconsistent positioning | Pricing needed a standard framework |

Cost Visibility | Costs were visible in aggregate but not always tied to specific courses | Made course-level profitability unclear | Course-wise cost mapping was required |

Domestic vs International Mix | International revenue played a meaningful role across courses | Exposed different buyer behaviour by geography | Segregation improved planning and GTM clarity |

Sales Dependency | Course sales were sensitive to marketing and founder involvement | Highlighted operational risk | Reduced dependency through structure |

Forecast Reliability | Revenue forecasting was largely assumption-driven | Limited forward planning | Structured tracking improved predictability |

Operational Effort vs Return | Some courses consumed high effort with lower returns | Created hidden inefficiencies | Effort needed to follow revenue |

Phase 3 – GTM, Sales & Distribution Blueprinting

Once financial visibility improved, Pitchworks worked with the team on GTM and distribution design, not execution. Marketing-to-sales handoffs were mapped, sales funnels were designed, and a structured distribution process particularly for offline initiatives was conceptualised. Course and program launch workflows were documented from ideation through delivery.

Importantly, during this engagement, many of these workflows were mapped and partially implemented, but not fully institutionalised. This was a conscious choice. The priority was to create a repeatable blueprint that the team could execute on sustainably, rather than force premature standardisation.

As part of this work, core GTM metrics such as CPC, CAC, lead-to-conversion ratios, and channel-level performance visibility were defined and tracked more systematically for the first time. This immediately surfaced inefficiencies in spend allocation, attribution gaps, and conversion drop-offs that were previously invisible. While these workflows were only partially implemented during the engagement, early signal-level improvements and clearer KPI ownership validated the approach. The intent was not to force optimisation prematurely, but to establish a repeatable, data-backed GTM blueprint that the team could sustainably execute and improve on post-engagement.

This tracker provides a consolidated view of all finance, fundraising, sales, and partnership activities, clearly mapping ownership, timelines, and execution status. It highlights completed financial groundwork, ongoing initiatives, and pending strategic actions, enabling transparent progress tracking and prioritisation. Overall, it served as a single source of truth for operational visibility and decision alignment during the engagement.

Online Performance & Analytics Audit

Pitchworks conducted a structured audit of Google Analytics and performance marketing setups to understand how online demand was being generated and measured. Arun did a good job on audit and end to end framing.Traffic sources, user journeys, and funnel drop-offs were reviewed across Google and Meta channels to assess attribution accuracy. Campaign structures, targeting logic, and spend patterns were analysed to identify inefficiencies. As part of this process, key GTM metrics such as CPC, CPL, lead-to-enquiry ratios, and channel-level performance visibility were defined for consistent tracking. This audit surfaced gaps in attribution and measurement that limited clear performance evaluation.

Online Performance & Analytics Audit

Activities completed:

Conducted a Google Analytics audit to review traffic sources, user journeys, and drop-offs

Audited performance marketing setup across Google and Meta

Reviewed campaign structure, targeting logic, and attribution assumptions

Mapped how online traffic translated (or failed to translate) into leads and enquiries

KPIs defined:

Cost Per Click (CPC)

Cost Per Lead (CPL)

Lead-to-enquiry conversion rate

Channel-wise traffic contribution

Drop-off points across the funnel

Marketing-to-Sales Funnel Design

The team mapped the end-to-end journey from marketing touchpoints to sales follow-ups, focusing on where leads were handed off and where momentum was lost. Sales funnel stages were designed conceptually to align marketing output with sales readiness. Follow-up processes and response timelines were reviewed to reduce ambiguity in ownership. KPIs such as lead-to-sales handoff rate, follow-up time, and stage-wise conversion ratios were defined to bring structure to the funnel. The outcome was a clear, repeatable funnel design ready for disciplined execution.

Again Arun Paandi did a fabulous job on mappy and redoing the funnel which took 3 months of time Activities completed:

Mapped the end-to-end funnel from awareness to conversion

Defined marketing-to-sales handoff stages

Identified gaps between lead generation and follow-up

Designed a structured sales funnel (conceptual, not fully enforced)

KPIs defined:

Lead-to-sales handoff rate

Follow-up time

Stage-wise conversion ratios

Funnel leakage points

Offline Distribution & New Channel Exploration

Alongside digital channels, Pitchworks explored potential offline distribution opportunities to diversify demand sources. New vendor and partner models were conceptualised, with evaluation criteria defined before any commercial engagement. The focus remained on feasibility and scalability rather than immediate conversions. KPIs such as partner pipeline size, cost per experiment, and conversion feasibility were outlined to guide future execution. No offline conversions were closed during this phase, by design.

Course & Program Launch Workflow

Pitchworks documented course and program launch workflows from ideation through delivery, identifying dependencies across content, marketing, sales, and operations. Manual steps and founder-led bottlenecks were highlighted to improve planning accuracy. Launch readiness criteria were defined to ensure consistency across programs. KPIs such as time-to-launch, conversion per launch, and campaign readiness completion were introduced to evaluate effectiveness. This created a predictable launch framework without enforcing rigid standardisation prematurely.

We even worked on a PGP crouse which we pitched along with the founder to couple of accelerator

Offline Distribution & New Channel Exploration

Alongside digital channels, Pitchworks explored potential offline distribution opportunities to diversify demand sources. New vendor and partner models were conceptualised, with evaluation criteria defined before any commercial engagement. The focus remained on feasibility and scalability rather than immediate conversions. KPIs such as partner pipeline size, cost per experiment, and conversion feasibility were outlined to guide future execution. No offline conversions were closed during this phase, by design.

Activities completed:

Identified new offline distribution possibilities (vendors, partners, institutions)

Designed a conceptual offline distribution model

Defined evaluation criteria for potential offline partners

No commercial conversions were executed during this phase

KPIs defined:

Partner pipeline count

Cost per distribution experiment

Conversion feasibility per partner

Scalability score (qualitative)

Pitchworks VC Studio operates as a 360-degree ecosystem partner, placing founders at the centre of a connected innovation network. The model integrates investors, funds, consultants, corporate innovation teams, and research universities into a single operating framework. Instead of working in silos, these stakeholders interact continuously to support company building, scaling, and strategic decision-making. Founders benefit from coordinated access to capital, expertise, enterprise partnerships, and research-led validation. Underpinning the entire system is continuous market intelligence, ensuring decisions remain grounded in real-world signals rather than assumptions.

Phase 4 – Tools, Systems & Documentation

To support the new structure, Pitchworks introduced and aligned the team around basic but essential tools. Zoho CRM and Zoho Books were introduced for customer and financial visibility, supported by structured Google Sheets for tracking and shared Google Docs for documentation. Ad performance visibility was improved through Meta and Google dashboards linked to internal trackers.

This phase was less about tools themselves and more about creating a single source of truth. As a result, founder workload reduced slightly, primarily because decisions no longer required reconstructing information from scratch each time.

Fundraising & Investor Readiness Work

In parallel, Pitchworks supported Gamer2Maker on investor readiness, not fundraising execution. This included framing the investor narrative, refining pitch deck structure and logic, identifying gaps investors would question (, and advising on timing and readiness. The company did pitch to select investors during and after the engagement; however, no investments closed during this phase, and no claims are made otherwise.

The value here was preparation: ensuring that when capital conversations happened, the company would be structurally credible.

This tracker provides a consolidated view of student performance, revenue metrics, and cost structure for the business. It captures key indicators such as active students, churn, average student value, course profitability, monthly and cumulative revenue, and bank reconciliation status. The sheet also tracks growth projections, target setting, and expense breakdown as a percentage of sales, enabling better financial control. By combining student outcomes with financial visibility, it helps link operational activity to commercial performance. Overall, it serves as a decision-support dashboard for monitoring health, efficiency, and growth readiness.

This engagement did not deliver short-term revenue outcomes, aggressive growth, or closed funding. It did deliver foundational clarity, internal alignment, improved visibility for the founder, and a clear GTM and distribution blueprint. Any growth that occurred after the engagement cannot be attributed solely to Pitchworks. At most, Pitchworks contributed by reducing friction and building a base upon which execution could later compound. Gamer2Maker’s case reflects a broader pattern seen in creator-led and early-revenue companies. Growth often comes before structure, but scale never survives without it. Pitchworks’ VC Studio model is designed for this exact moment — when momentum exists, but systems lag behind.

The real outcome of this engagement was not numbers, but readiness. Gamer2Maker exited the engagement better positioned to scale intentionally, engage investors with confidence, and execute with clarity rather than chaos.

By structuring finance, mapping GTM and operations, and defining measurable KPIs, the business moved from intuition-led decisions to visibility-driven planning. While short-term execution outcomes were not the goal, the work reduced friction and increased internal alignment. The company emerged better prepared for scale, distribution expansion, and investor scrutiny. Most importantly, it now has a repeatable framework to convert momentum into long-term progress.

It was a privilege for Pitchworks to work alongside Rahul Sehgal, whose vision for Gamer2Maker went far beyond building a platform. Rahul believed deeply in empowering gamers to become creators, in treating gaming as a serious craft, and in building an ecosystem where passion could translate into capability. He brought rare honesty, quiet conviction, and long-term thinking to everything he pursued. His background, global exposure, and respect for structured learning shaped the direction of this journey in meaningful ways. While his absence is profoundly felt, the intent, values, and foundations he laid continue to guide the path forward. This work stands as a reflection of his vision and a commitment to carry it ahead with the same integrity.

Gamer2Maker has built Super traction organically as a gaming education platform, with 250+ students trained, 12+ years of combined instructor experience, and outcome-oriented programs that highlight an average salary benchmark of ₹7.5 lakh for learners entering industry roles. The platform is also an approved skilling partner of Medhavi Skills University (MSU), collaborating on Bachelor of Vocation and Professional Diploma programmes an important signal of institutional alignment and curriculum credibility.

As Gamer2Maker enters its next phase, the focus is shifting from early traction to institutional trust, corporate partnerships, and investor. This requires moving beyond marketing-led claims toward evidence-backed positioning, clearer articulation of learning outcomes, and stronger alignment with industry needs. The ambition is not just to be a course platform, but to become a structured talent pipeline for the gaming ecosystem, connecting learners, studios, universities, and employers. To support this transition, Gamer2Maker is refining how it communicates impact prioritising verifiable outcomes, academic partnerships, and industry relevance over broad superlatives. This evolution strengthens credibility with investors and corporates, while preserving the original mission: turning gamers into creators and professionals, and expanding the reach of Indian gaming talent into global markets. I am sure current Gamer2Maker team is doing a Great job in making Rahuls vision come true of building world largest gaming university.

Comments